Mayank Singhvi is an experienced investment banker and financial specialist who leads strategic growth in countries throughout the world. Mayank has been in charge of mergers and acquisitions, private equity, and alternative investments for more than 20 years. He is also quite creative. Find the latest news, insights, and media coverage on his influential career here.

September 01, 2021

Global Awards 2020-21 honoured and felicitated to the leading organizations and professionals from different industries

View Full ArticleMarch 10, 2021

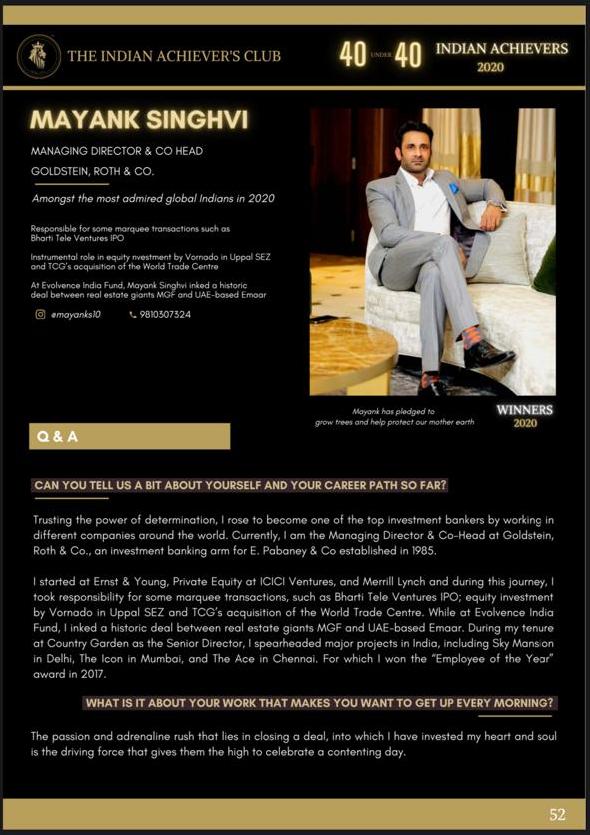

Every step one takes forward requires undying effort and a determination to never stop. For Mayank Singhvi, these are not mere words but the golden rule to live.

View Full Article

Oct 7, 2020

NOIDA, India, Oct. 7, 2020 /PRNewswire/ -- Mayank Singhvi has been appointed as Managing Director and Co-Head of investment banking by Goldstein, Roth & Company. Goldstein , Roth & Co. is the investment banking arm for E.

View Full ArticleSep 24, 2020

Prior to this, Mayank was Senior Director with Country Garden, world's largest real estate developer, which is ranked 353rd on the Fortune Global 500 list

View Full Article

Apr 03, 2024

Cosmos Group, a diversified business conglomerates, on Tuesday, lunched its maiden Alternative Investment Fund (AIF). The fund aims to raise Rs 500 crore, with an additional green shoe option of Rs 250 crore. With the fund launch, the group aims to back SME (Small and Medium Enterprises) sector.

View Full ArticleApr 03, 2024

Cosmos Group, a diversified business conglomerates, on Tuesday, lunched its maiden Alternative Investment Fund (AIF). The fund aims to raise Rs 500 crore, with an additional green shoe option of Rs 250 crore. With the fund launch, the group aims to back SME (Small and Medium Enterprises) sector.

View Full ArticleApr 03, 2024

Cosmos Grouptoday announced its foray into the Alternative Investment Funds (AIF) landscape with the launch of its maiden AIF. The fund aims to raise INR 500 crore, with an additional green shoe option of INR 250 crore, showcasing the group's commitment to empowering the SME sector.

View Full ArticleMar 29, 2023

New Delhi [India], March 28 (ANI/GPRC): IMK Capital, a leading private equity firm, has announced its investment in AVPL, a fast-growing technology company, at a valuation of 500 Cr. This strategic investment will enable AVPL to accelerate its growth and expansion plans, bolster its research and development efforts, and enhance its product offerings.

View Full ArticleApr 17, 2024

New Delhi [India], April 17: IMK Capital, a prominent global asset management firm, has recently announced its ambitious commitment to the Indian market, pledging a staggering sum of over USD 700 million. This bold move underscores the firm's confidence in India's economic potential and its strategic vision for expansion in one of the world's fastest-growing economies.

View Full ArticleJan 24, 2021

Trusting the power of determination, Mayank Singhvi rose to become one of the top investment bankers by working in different companies around the world. Currently, he is the Managing Director & Co-Head at Goldstein, Roth & Co., an investment banking arm for E. Pabaney & Co established in 1985. Through partnerships with international investment banks and funds, the company provides sources of capital to businesses. Goldstein, Roth & Co. has partners that come from government, business, and finance that bring a unique business-owner perspective to the investment banking process. A profession like investment banking requires a particular set of skills that makes people want to trust you.

View Full ArticleApr 17, 2024

PNN New Delhi [India], April 17: IMK Capital, a prominent global asset management firm, has recently announced its ambitious commitment to the Indian market, pledging a staggering sum of over USD 700 million. This bold move underscores the firm’s confidence in India’s economic potential and its strategic vision for expansion in one of the world’s

View Full ArticleApr 17, 2024

IMK Capital, a global asset management firm, has announced a substantial investment of over USD 700 million in the Indian market, highlighting the firm

View Full ArticleApr 17, 2024

Weekends are all about downtime. After a week full of work to meet deadlines, everybody needs some breather to relax and recuperate. From watching a favourite web series to planning a vacation, weekends are designated as family and me time.

View Full ArticleJune 24, 2024

In recent years, venture capital (VC) and private equity (PE) have emerged as powerful catalysts for innovation and economic growth globally. This surge represents a pivotal shift in the financial landscape, reshaping industries and fostering entrepreneurship in unprecedented ways.

View Full Article

July 24, 2024

Post the General elections which resulted in a fractured mandate after a decade the union budget 2024-25 is keenly awaited. Boosting economic and job growth in India is a primary concern requires a comprehensive approach that spans various sectors and addresses both supply and demand factors. Here are some key strategies for the same :

View Full ArticleJune 04, 2025

For over 20 years, Mayank Singhvi has worked in private equity, investment banking, and financial strategy. He has led high-profile technology, real estate, and alternative investment deals and growth ventures. His career stands out for its strong focus on innovation, leadership, and achieving tangible results.

View Full ArticleJune 04, 2025

At Mayank Singhvi, we offer strategic financial recommendations and skilled investment advice. We help customers expand sustainably with extensive market knowledge and creative ideas from decades of industry expertise. Everything we do is based on ethics, cooperation, and quality, helping companies globally succeed.

View Full ArticleFeb 03, 2026

DuneVista Capital, a Dubai-based asset management firm, has launched a $1 billion global investment fund and secured capital commitments for the same.

View Full ArticleFeb 03, 2026

Alongside its startup investments, the fund will also make selective allocations across private equity, public markets, hedge funds and commodities as part of a diversified investment strategy.

View Full ArticleFeb 03, 2026

Indian-led asset manager DuneVista Capital on Monday said it will launch a USD 1 billion global investment fund with India as a core market, ahead of its formal debut at the World Economic Forum Annual Meeting in Davos on 21 January 2026.

View Full ArticleFeb 03, 2026

The firm has already deployed USD 60 million across India and the Middle East from the fund, with India identified as a core market for the fund’s current investment cycle.

View Full ArticleFeb 03, 2026

Alongside its startup investments, the fund will also make selective allocations across private equity, public markets, hedge funds and commodities as part of a diversified investment strategy.

View Full ArticleFeb 03, 2026

The fund will focus primarily on investments in Indian startups and growth-stage companies. Alongside this, DuneVista Capital will pursue selective investments across private equity.

View Full ArticleFeb 03, 2026

Investment firm DuneVista Capital has secured capital for a USD 1 billion global fund and allocated USD 100 million for the Indian market, the company said on Tuesday. The firm has already deployed USD 60 million across India and the Middle East from the fund, with India identified as a core market for the fund's current investment cycle.

View Full ArticleFeb 03, 2026

DuneVista Capital has announced securing $1 billion for a global fund, allocating $100 million specifically for the Indian market. The fund’s focus is on Indian startups, growth-stage companies, and women-led businesses. It marks early investment activity in India and the Middle East ahead of its formal launch.

View Full ArticleFeb 03, 2026

DuneVista Capital, an Indian-led global asset management group, has secured capital for a $1 billion global fund. As part of its India-focused approach, DuneVista Capital has committed an additional $100 million to Indian and India-linked investment platforms

View Full Article